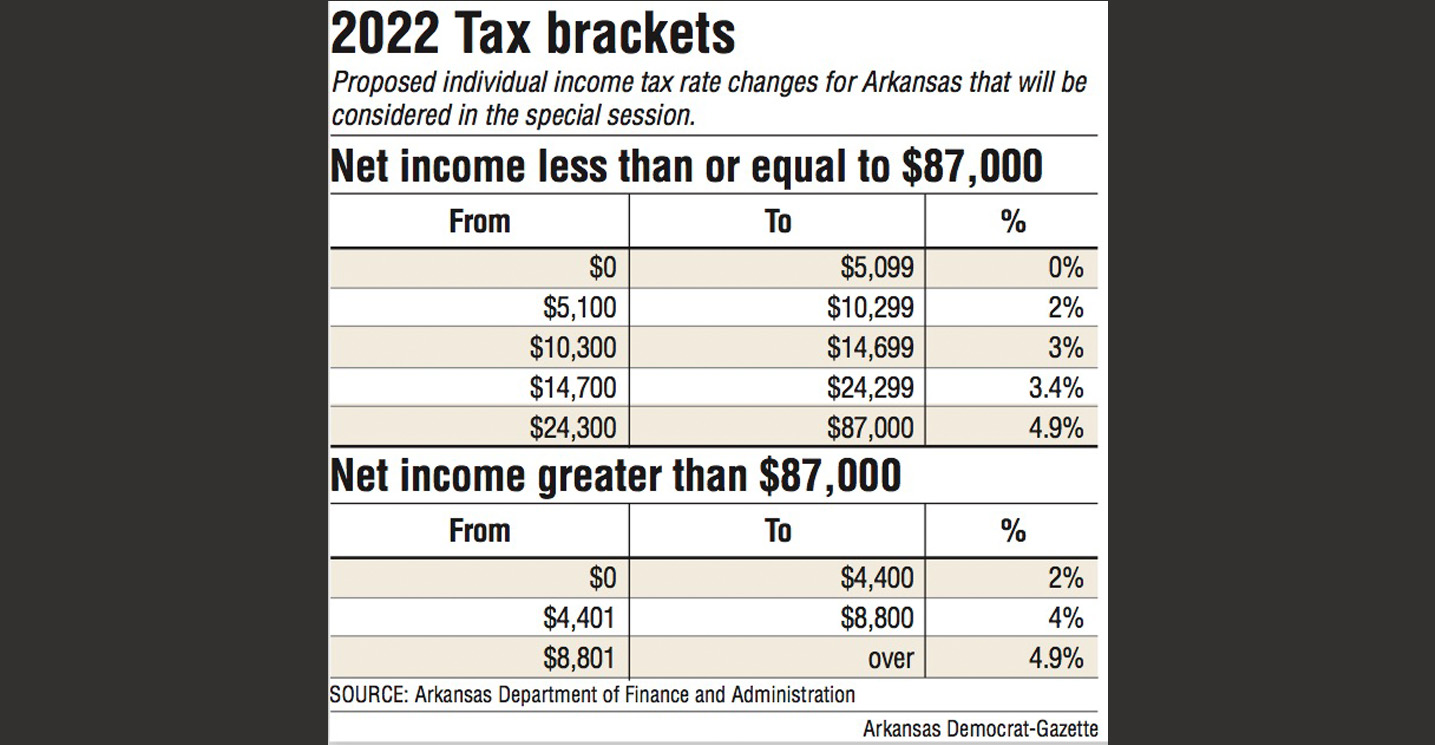

Tax Brackets 2025 Arkansas. Arkansas state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. Calculations are estimates based on tax rates as of jan.

The tax tables below include the tax rates, thresholds and allowances included in the arkansas tax calculator 2025. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

2025 Tax Brackets Mfj Limits Brook Collete, Still need to prepare and file an ar return for a previous tax year? The median household income across all 345 cities is $77,345, making.

Tax rates for the 2025 year of assessment Just One Lap, Sarah huckabee sanders, reducing these two taxes will cut $150 million from personal income tax and $36 million from corporate income tax. The tax tables below include the tax rates, thresholds and allowances included in the arkansas tax calculator 2025.

Arkansas Lawmakers Enact Middle Class Tax Cut, Married couples have the option to file separate tax returns, which is known as married filing. Your household income, location, filing status and number of personal exemptions.

It’s All About the Context A Closer Look at Arkansas’s Tax, 2025 and data from the tax. To estimate your tax return for 2025/25, please select.

State Corporate Tax Rates and Brackets Tax Foundation, Sarah huckabee sanders, reducing these two taxes will cut $150 million from personal income tax and $36 million from corporate income tax. If you make $70,000 a year living in wisconsin you will be taxed $10,401.

Tax cut bills approved by Arkansas House, Senate, 2 by the state department of finance and administration. Notable changes to major individual income tax provisions already certified for 2025 include the following:

Tax Brackets 2025 Table Pdf Tandi Florella, The median household income across all 345 cities is $77,345, making. It ranges from $500 for a corporation with gross receipts less than $100,000, to $2,000 for a corporation with gross receipts of $1 million or more.

Ca State Tax Brackets 2025 Bobbi Chrissy, Arkansas income tax forms, tax brackets and rates are listed here by tax year. Efiling is easier, faster, and safer than filling out paper tax forms.

Tax Brackets Explained Seymour & Perry, LLC Athens CPA, File your arkansas and federal tax returns online with turbotax in minutes. In the last decade, however, the personal income tax.

What Are Tax Brackets, The median household income across all 345 cities is $77,345, making. Arkansas state income tax rates and tax brackets.

Arkansas state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.